Atlanta is a city that never really slows down. From the early morning rush to late-night commutes, it’s a place where people depend on their cars for just about everything – work, running errands, getting kids to school, and weekend trips. With all this driving comes one unavoidable fact: car insurance.

But looking at bills around town, drivers often wonder why their premiums look so different from their neighbors’. One person pays a modest sum, while someone with a similar car and lifestyle ends up with a much heftier bill. It’s a common question – why do insurance costs seem so unpredictable here in Atlanta?

There’s no easy answer. Insurance companies dig into everything – how you drive, what kind of car you have, where you live, your credit score, all of it. In a place like Atlanta, with crazy traffic, suburbs that go on forever, and packed city areas, all that stuff adds up in ways most people never see coming.

What Really Moves the Needle on Insurance Costs?

Contents

- What Really Moves the Needle on Insurance Costs?

- How to Keep Auto Insurance Costs Down

- Why Shoppers Should Get Multiple Quotes

- How Driving Patterns Shape Insurance in Atlanta

- Everyday Choices Matter More Than Expected

- Keeping Policies Up to Date With Life

- What Insurance Looks Like in Georgia Beyond Atlanta

- The Balance Between Cost and Protection

Rather than just charging a flat fee, insurance providers look at a number of things that make each driver unique:

- Driving Record: This is the clearest signal. Clean, accident-free years mean lower rates. A single ticket or accident, even a minor one, can send costs up.

- Type of Vehicle: A beat-up old sedan isn’t the same expensive gamble for an insurer as a brand-new SUV or a luxury car. Crash damage costs differ wildly depending on make and model.

- How Much You Drive: If you’re driving 50+ miles a day on packed highways, you’re way riskier than someone who just runs to the grocery store once in a while.

- Where You Park: Keep your car in your own garage and you’ll pay less than someone who has to leave theirs on the street in a sketchy neighborhood.

- Your Insurance History: Keep your coverage going without any gaps and companies will reward you. Let it lapse and they’ll see you as risky and jack up your rates.

- How You Handle Money: Your credit score matters too. Good credit tells them you’re responsible and they’ll usually give you better rates because of it.

Put these together, and drivers living just a few miles apart can get very different quotes.

How to Keep Auto Insurance Costs Down

While some of the above – like the type of car or where one lives – aren’t easy to change, there are practical steps drivers can take:

- Go With a Higher Deductible: Pay more out of pocket when something happens and your monthly bill goes down. Works great if you’re a careful driver who probably won’t need to use it much.

- Bundle Everything Together: Get your car and home or renters insurance from the same place and you’ll usually save money on both.

- Keep Your Coverage Going: Don’t let your insurance lapse even for a day – they’ll punish you with higher rates when you start back up.

- Hunt for Discounts: Good driving record, decent grades, don’t drive much, all kinds of programs most people never even ask about. Just ask – you might be shocked at what you can save.

- Review Coverage Regularly: Sometimes policies carry add-ons or coverages that no longer make sense for current situations. Cutting unnecessary parts saves money.

Taken together, these small moves add up to meaningful savings over time – even without big lifestyle changes.

Why Shoppers Should Get Multiple Quotes

Many Atlantans stick with the first insurer they tried or simply renew out of habit. That offers convenience, but it can leave money on the table because insurance companies often reward newcomers with introductory discounts. Staying loyal too long may cost more than shopping around.

Getting quotes from multiple providers every year or two is a smart move. Comparing options helps drivers see the current market and find better pricing or more suited coverage. But quotes shouldn’t be judged by price alone. Deductibles, claim responsiveness, coverage limits, and roadside service all add real value.

Local and regional companies like GoAuto Insurance also deserve a spot in these comparisons. They often tailor their products better to Atlanta’s roads and risks than nationwide carriers do.

How Driving Patterns Shape Insurance in Atlanta

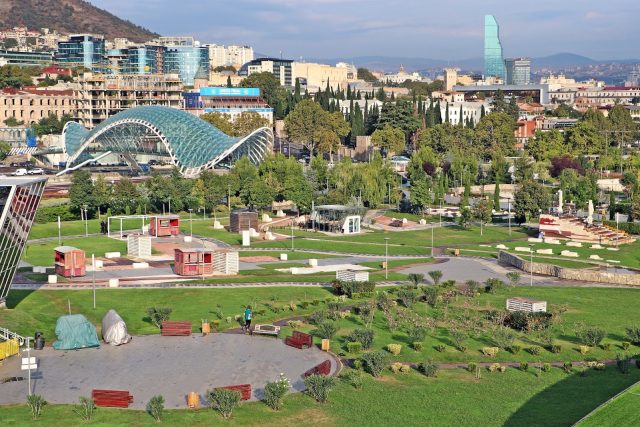

Atlanta’s urban-sprawl mix creates an interesting and challenging environment for drivers and insurers alike. Some neighborhoods are quiet and suburban; others buzz with heavy traffic and complex driving conditions.

The average Atlanta family might have one or two cars, plus one or two teen drivers starting their insurance journey. Commuters face daily highway congestion that boosts accident odds. Weekend drivers hitting local roads see a different risk profile.

This blend means one-size-fits-all insurance doesn’t fit well here. For many, finding the right car insurance in Atlanta is about finding plans that understand these local realities, not generic offerings from broad national programs.

Everyday Choices Matter More Than Expected

Beyond driving records and mileage, insurers watch other habits:

- Where You Park: Keep your car in a garage and you’ll pay less than someone who leaves theirs on the street all night.

- Take Care of Your Car: Keep your brakes working, get new tires when you need them, make sure your lights work – all that prevents crashes caused by broken stuff on your car.

- Your Credit Score: Good credit makes you look less risky and usually gets you lower rates.

- Managing Young Drivers: Teens impose higher rates, but many programs reward safe teens with steep discounts for classes or good grades.

All these factors gradually feed into a profile insurers use to judge cost.

Keeping Policies Up to Date With Life

Driving changes when life changes – new jobs, remote work, moving house, or kids starting to drive.

Many people don’t update their policies when these shifts happen. That means they might be paying for risks they no longer have, or missing out on discounts they qualify for.

Calling the insurer once a year or when big changes happen can keep costs fair and coverage current.

What Insurance Looks Like in Georgia Beyond Atlanta

Different parts of Georgia come with their own problems. If you’re near the coast, you’re dealing with floods and storms. Out in the country, you’re driving forever without much traffic but you’ve got deer jumping out at you and people going way too fast on empty roads. In Atlanta, you’re stuck in traffic jams and constantly dodging fender-benders.

Exploring options for cheap car insurance in Georgia helps people across the state find the right coverage for their local needs.

The Balance Between Cost and Protection

Everyone wants to pay less each month, but the cheapest option may leave gaps that sting later.

Good insurance should protect against common risks you meet on Atlanta’s roads – collisions, theft, weather damage – without straining your budget.

Smart drivers look for this middle ground and adjust when their lives change, not chasing the bottom dollar but sensible protection.