MileBug – Mileage Log & Expense Tracker for Tax Deduction is an app from developer Jason Izatt that makes keeping track of corporate mileage as breeze.

If you, like many Americans, need to travel as part of your job then mile-tracking is vital. Without it, you can’t claim a tax deduction on business miles. An IRS-compliant app and highly recommended in accounting circles, MileBug for iOS is one of the best ways to keep tabs on your milage and work trips.

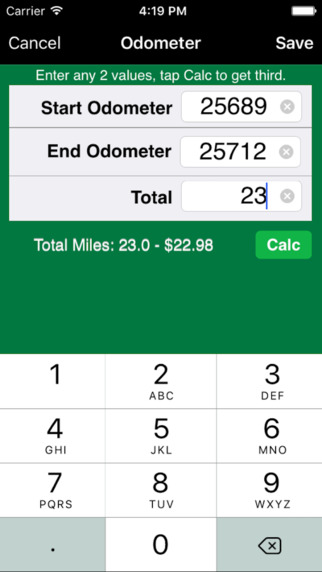

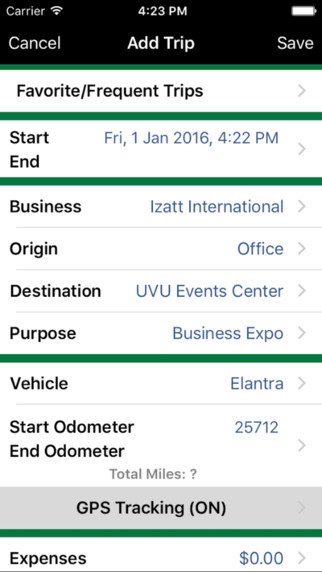

Getting started is easy. Once you’ve downloaded MileBug, just tap the [+] button to add a trip. You can select whether the trip is for Business, Charity, Medical or Personal as well as choosing an Origin and Destination. The app allows you to track multiple businesses as well as multiple vehicles. Once your origin and end-point are entered, you’ll need to enter your Start Odometer reading. Utilizing GPS tracking, MileBug can calculate exactly how far you’ve travelled or alternatively you can manually enter the End Odometer reading to work out total miles.

It’s also easy to save time by selecting the ‘Favorite/Frequent’ option, which pre-populates with trip information to save time when you make a common trip. Whilst the app defaults to U.S. miles and cents, MileBug is also internationally compatible and you can change the settings to km’s and set custom rates based on your country’s own tax rebates.

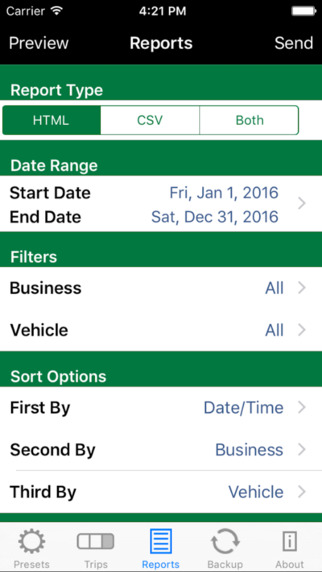

Because record-keeping is so important when it comes to tax, MileBug syncs with the Cloud so you can keep all of your trip data backed up wirelessly. Alternatively, you can choose to export your trip data in HTML or CSV and email it to yourself from within the application.

With IRS deduction rates set at 54 cents per mile this year, it will only take a single short trip to offset the cost of this $2.99 app.

MileBug requires iOS 7.1 or later. Compatible with iPhone, iPad, and iPod touch.