With open banking becoming mainstream in 2020, we can expect a host of new financial technologies to emerge. It includes data aggregators and payment initiation service providers. As they strive to take their place in the financial services market. They will be joined by tech giants as they strive to play prominent role in this market.

2021 will be a pivotal year for the technology behind cryptocurrencies. Fintech looks forward to more widespread use of distributed ledger technology. So blockchain will find its place in financial services. But it’s outside of the cryptocurrency world. Other innovative technologies, such as artificial intelligence and robotics automation, have also gone beyond the scope. And also there are emerging serious use cases.

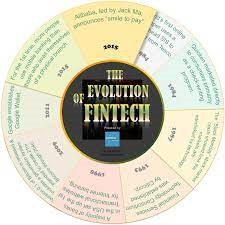

History of Fintech

Contents [show]

Fintech is hard to call a novelty. In one form or another, financial technology exists as much as financial. Following the global financial crisis of 2008, fintech companies began to grow. It changed commerce, investment, asset management, insurance and securities transactions.

It is thanks to fintech that the existence of cryptocurrencies, such as bitcoin, has become possible.

After the crisis of 2008, thousands of startups emerged. They realize that the confidence of consumers of financial services in the old format. It was shattered and the need for new financial business models was ripe.

How Has Fintech Evolved?

What is fintech banking? Banks and new market entrants seeking to register a fintech company in Europe are faced with many new challenges. They require specific solutions.

The more complex and interconnected supply chains have inherent impact of fintech on banks. It means that the vendor will often work with various third parties. It includes proprietary software vendors, cloud providers, and so on.

Those wishing to establish a FinTech company should be aware that many of them are disruptive FinTech startups and newcomers to the market. They use different ways to conclude contracts and provide their services. Therefore, it will be important that suppliers acting as integrators manage their contractual negotiating with their third parties.

Fintech Today

And although Fintech and banks cannot yet be called the dominant trend in the financial world, some companies have achieved significant success. And the fintech phenomenon itself has become an important link in the chain of financial services.

Fintech is also changing the insurance and investment industries.

For example, in the United States, car insurance companies already sell “telematics” insurance. Where your control is controlled by data collected through your smartphone or a “black box” installed in your car.

This data can be used to determine how much you pay for an insurance policy.

What Does Fintech Hold for the Future?

Over time, more and more people will be annoyed when they are forced to visit a physical bank branch for financial transactions.

Traditional banks can no longer rely on deposits, loans and current accounts as the basis of their business.

Competitors from fintech software development company Alty are already ousting banks from the most active industries. It turns them into utilitarian institutions.

The future of the banking industry will depend on its ability to influence consumer understanding. It enhanced analytics and digital technologies. It provides services that help today’s technology customers to better manage their finances. Also it covers their daily lives.

Final Thoughts

As both financial and technology companies demonstrate a broader view of the banking business. They offer both banking and non-banking services. The ultimate winner in this situation will be the consumer, regardless of which company is chosen.